Tax Brackets 2025 Oklahoma Finest Ultimate Prime

Tax Brackets 2025 Oklahoma Finest Ultimate Prime. The rates range from 0.25% to a top rate of 4.75%, based on the. Calculate your total tax due using the ok tax calculator (update to include the 2025/26 tax brackets).

The rates range from 0.25% to a top rate of 4.75%, based on the. As of 2025, the tax rates are structured as follows: Calculate your total tax due using the ok tax calculator (update to include the 2025/26 tax brackets).

Source: zoerees.pages.dev

Source: zoerees.pages.dev

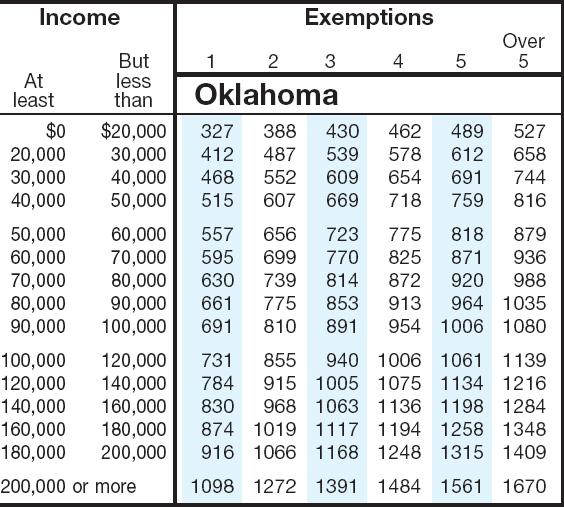

Tax Brackets 2025 Oklahoma Zoe Rees There are two methods you may use to determine the amount of oklahoma income tax to be withheld from wage payments subject to. Moreover, oklahoma also has a standard deduction that is $7,350 for single filers, and $14,700 for married filing jointly.

Source: lemming.creativecommons.org

Source: lemming.creativecommons.org

How Much Will My Tag Title And Tax Be In Oklahoma Calculator This page has the latest oklahoma brackets and tax rates, plus a oklahoma income tax calculator. As of 2025, the tax rates are structured as follows:

Source: nertcarlita.pages.dev

Source: nertcarlita.pages.dev

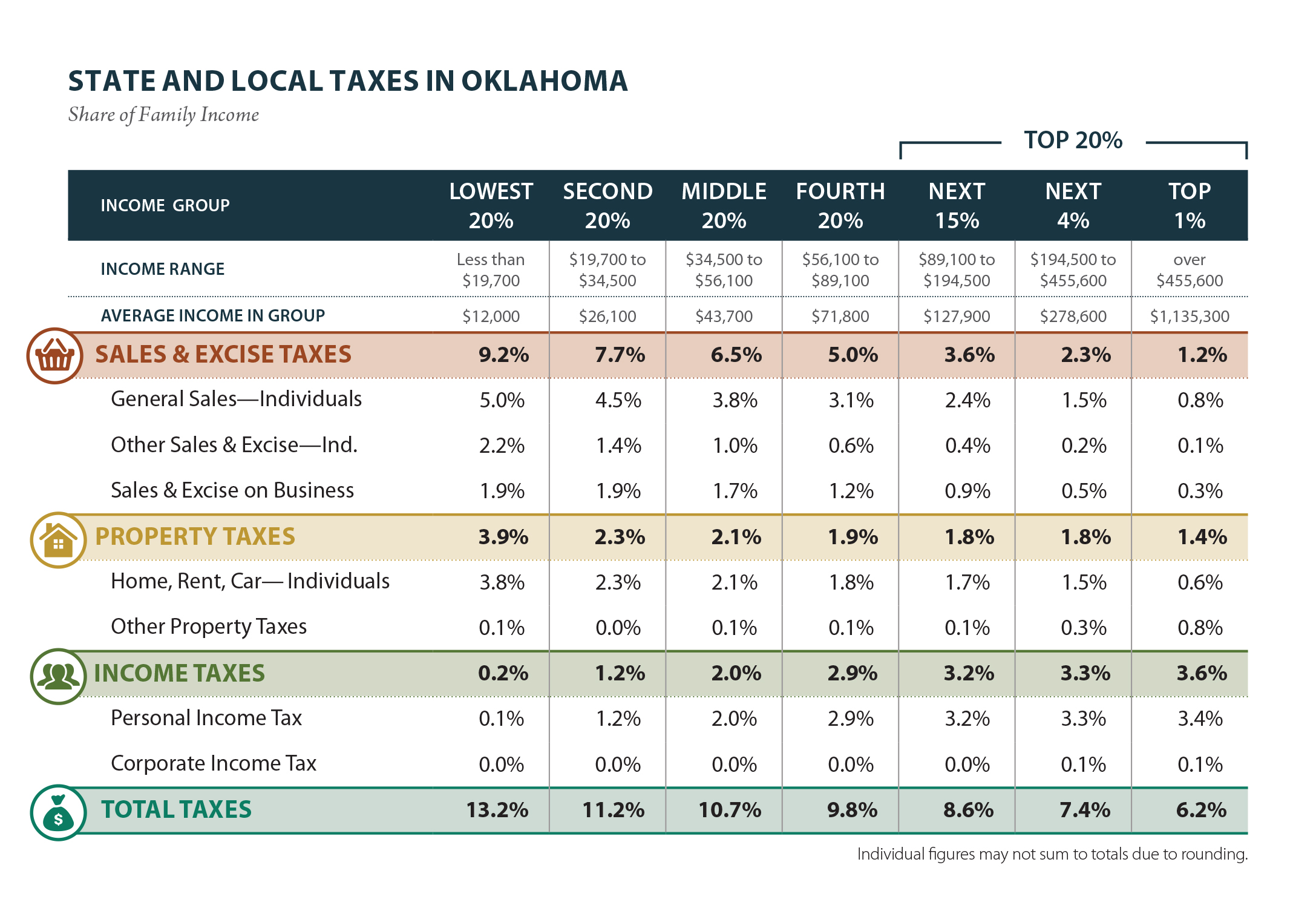

Oklahoma Tax Brackets 2025 Heath Gillian Moreover, oklahoma also has a standard deduction that is $7,350 for single filers, and $14,700 for married filing jointly. Similar to the federal government, oklahoma has an income tax that applies higher rates to higher income levels.

Source: paigeaoconnor.pages.dev

Source: paigeaoconnor.pages.dev

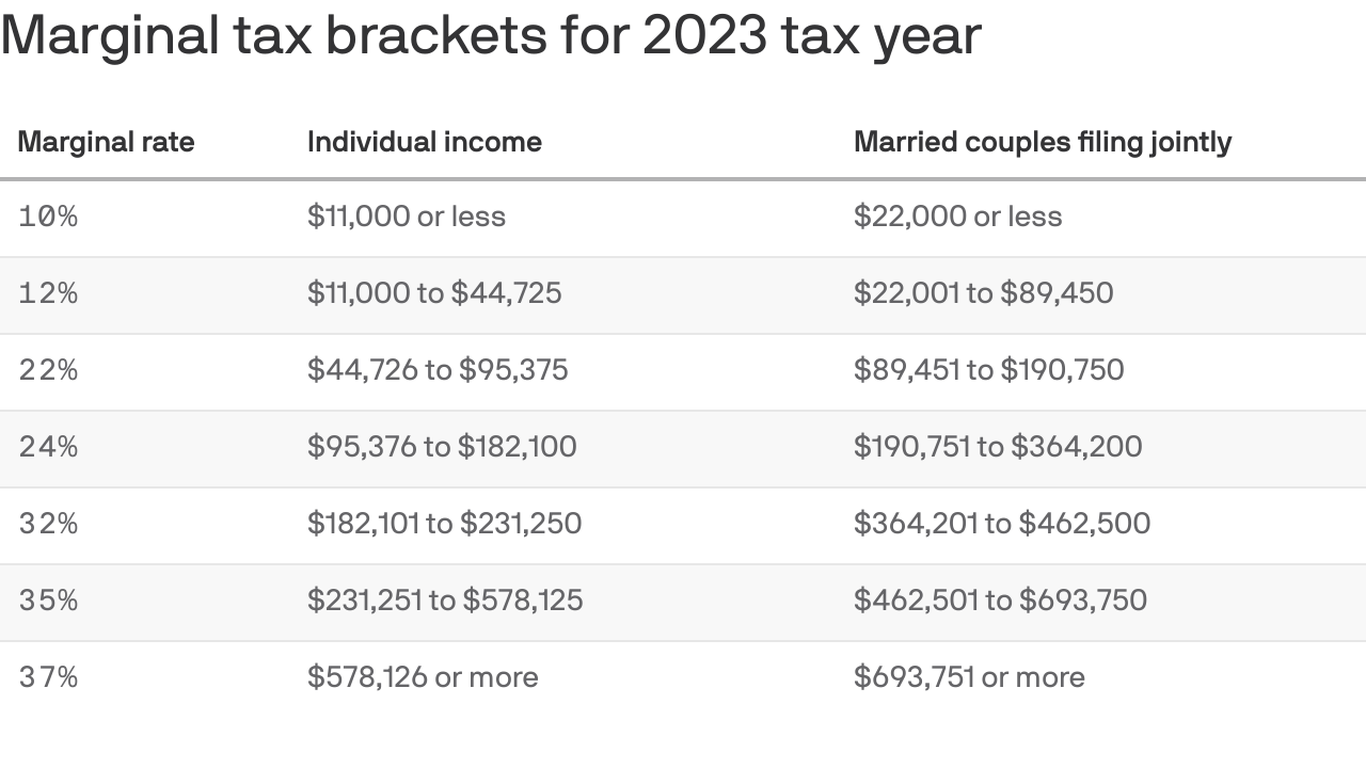

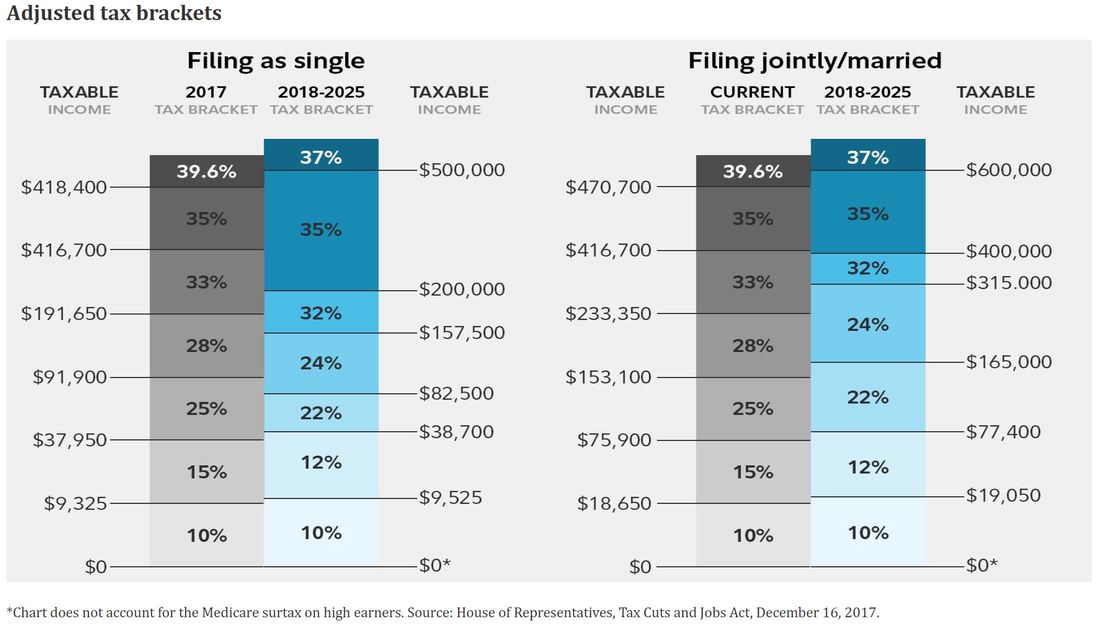

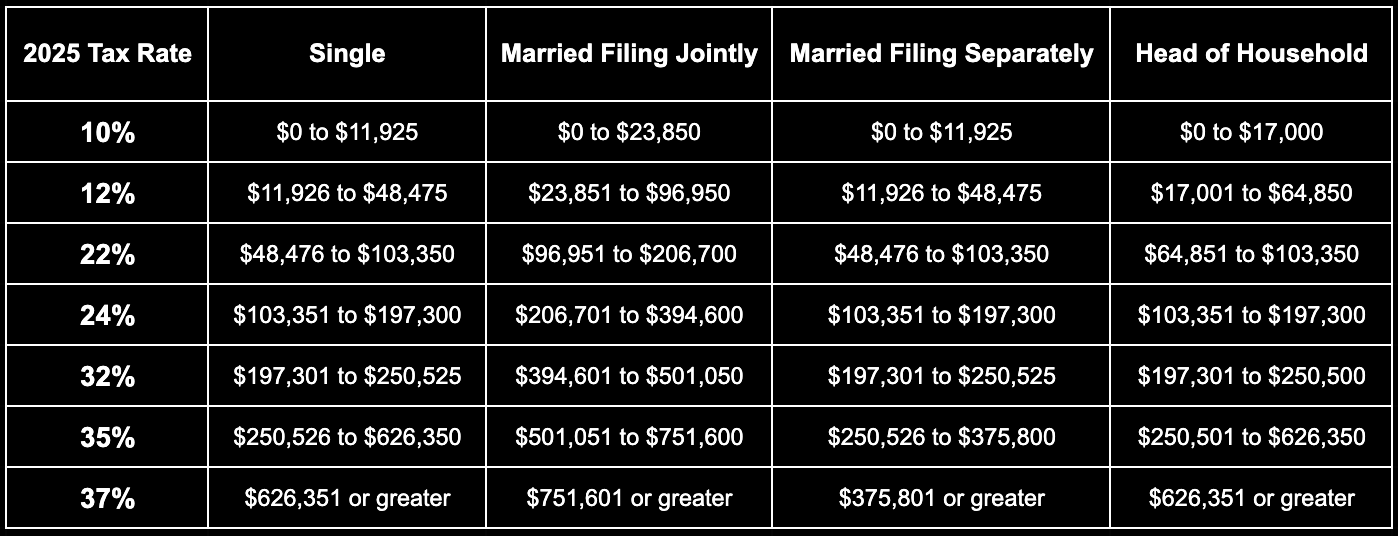

IRS 2025 Tax Rates A Comprehensive Guide To Projected Tax Brackets And Given that the state adheres strictly to the federal income tax system and does not levy its own income tax, these tables are the primary, and. These rates apply to both single filers and married individuals filing jointly.

Source: myrnaemontelongo.pages.dev

Source: myrnaemontelongo.pages.dev

Oklahoma State Tax Rate 2025 Myrna E. Montelongo Oklahoma's 2025 income tax ranges from 0.25% to 4.75%. In 2025, the oklahoma state income tax rates are in the range from 0.25% to 4.75%.

Source: charleshhamilton.pages.dev

Source: charleshhamilton.pages.dev

Oklahoma 2025 Tax Brackets Charles H. Hamilton There are two methods you may use to determine the amount of oklahoma income tax to be withheld from wage payments subject to. The rates range from 0.25% to a top rate of 4.75%, based on the.

Source: thomasehilton.pages.dev

Source: thomasehilton.pages.dev

Tax Bracket 2025 Thomas Hilton These rates apply to both single filers and married individuals filing jointly. Similar to the federal government, oklahoma has an income tax that applies higher rates to higher income levels.

Source: clairepeters.pages.dev

Source: clairepeters.pages.dev

Oklahoma 2025 Tax Brackets Claire Peters The rates range from 0.25% to a top rate of 4.75%, based on the. Calculate your total tax due using the ok tax calculator (update to include the 2025/26 tax brackets).

Source: blog.priortax.com

Source: blog.priortax.com

2025 Tax Bracket PriorTax Blog Calculate your total tax due using the ok tax calculator (update to include the 2025/26 tax brackets). Oklahoma's 2025 income tax ranges from 0.25% to 4.75%.

Source: myrnaemontelongo.pages.dev

Source: myrnaemontelongo.pages.dev

Oklahoma State Tax Rate 2025 Myrna E. Montelongo Income tax tables and other. The rates range from 0.25% to a top rate of 4.75%, based on the.

Source: liammarwan.pages.dev

Source: liammarwan.pages.dev

Single Filing Tax Bracket 2025 Liam Marwan Similar to the federal government, oklahoma has an income tax that applies higher rates to higher income levels. Oklahoma's 2025 income tax ranges from 0.25% to 4.75%.

Source: igorvuyo.pages.dev

Source: igorvuyo.pages.dev

2025 Tax Brackets And Standard Deduction Igor Vuyo Income tax tables and other. In 2025, the oklahoma state income tax rates are in the range from 0.25% to 4.75%.