Ya 2025 Tax Rebate Spectacular Breathtaking Splendid

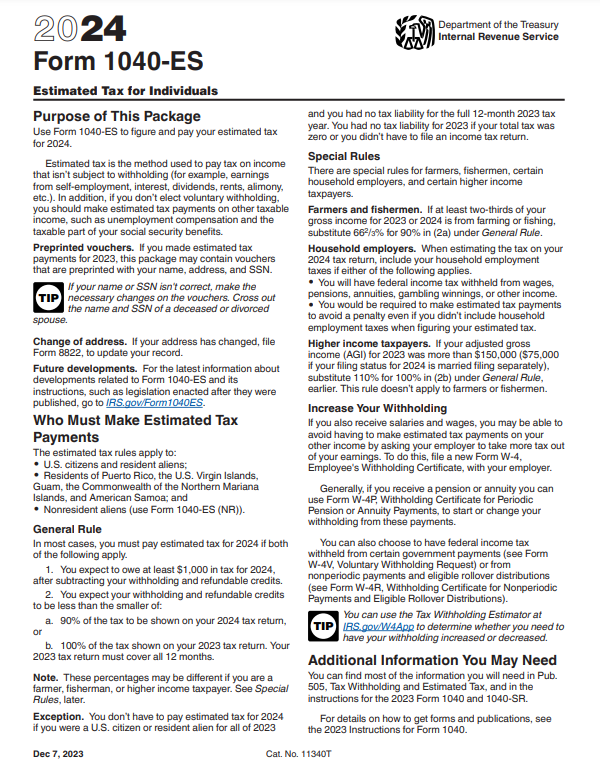

Ya 2025 Tax Rebate Spectacular Breathtaking Splendid. This chart summarizes the applicable income tax rates and deductions. The government will provide a personal income tax (pit) rebate of 60% of tax payable for all tax resident individuals for the year of assessment (ya) 2025 (i.e., for income earned in 2024).

This chart summarizes the applicable income tax rates and deductions. If the company has filed both their eci and company tax returns for ya 2025, iras will calculate the cit rebate based on the final tax. A personal income tax (pit) rebate for ya 2025 will.

Source: mariajdeloach.pages.dev

Source: mariajdeloach.pages.dev

Tax Rebate 2025 Trending Maria J Deloach A personal income tax (pit) rebate for ya 2025 will. This chart summarizes the applicable income tax rates and deductions.

Source: landco.my

Source: landco.my

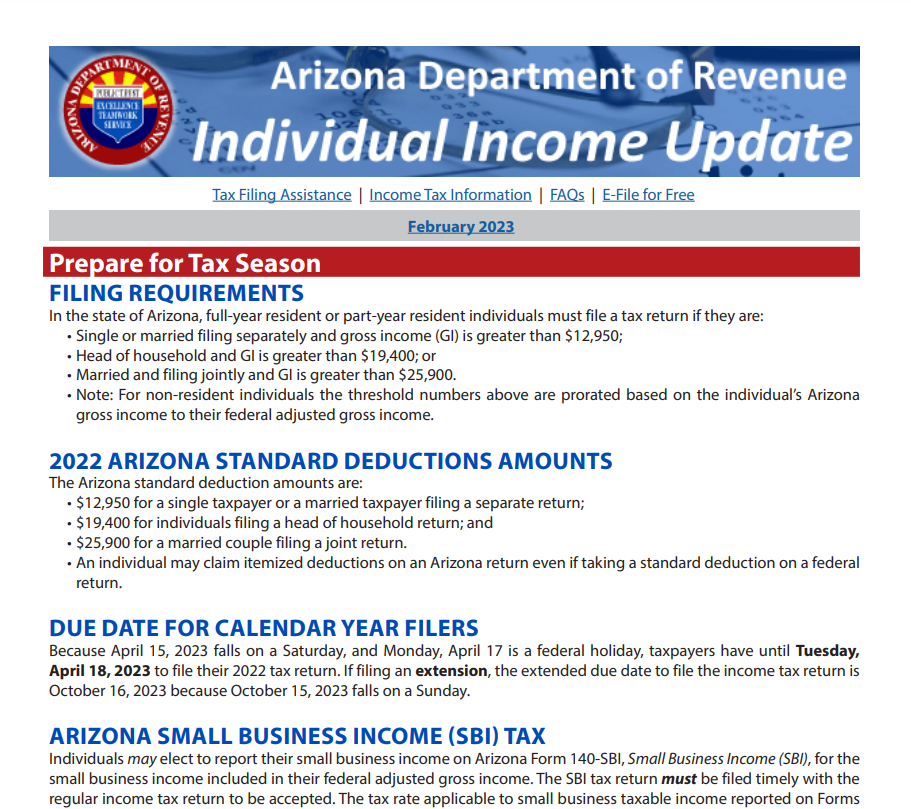

Personal Tax Relief Malaysia Y.A. 2023 L & Co Accountants As announced in budget 2025, to provide support for companies' cash flow needs, a cit rebate of 50% of the corporate tax payable will be granted. The government will provide a personal income tax (pit) rebate of 60% of tax payable for all tax resident individuals for the year of assessment (ya) 2025 (i.e., for income earned in 2024).

Source: www.jammuuniversity.in

Source: www.jammuuniversity.in

Carbon Tax Rebate January 2025 Payout Date, Amount, Eligibility This chart summarizes the applicable income tax rates and deductions. If the company has filed both their eci and company tax returns for ya 2025, iras will calculate the cit rebate based on the final tax.

Source: simonhughes.pages.dev

Source: simonhughes.pages.dev

Tax Rebate Ya 2025 Simon Hughes As announced in budget 2025, to provide support for companies' cash flow needs, a cit rebate of 50% of the corporate tax payable will be granted. To provide support for companies’ cash flow needs, a cit rebate of 50% of tax payable will be granted in ya 2025.

Source: simonhughes.pages.dev

Source: simonhughes.pages.dev

Tax Rebate Ya 2025 Simon Hughes To provide support for companies’ cash flow needs, a cit rebate of 50% of tax payable will be granted in ya 2025. As announced in budget 2025, to provide support for companies' cash flow needs, a cit rebate of 50% of the corporate tax payable will be granted.

Source: simonhughes.pages.dev

Source: simonhughes.pages.dev

Tax Rebate Ya 2025 Simon Hughes A personal income tax (pit) rebate for ya 2025 will. To provide support for companies’ cash flow needs, a cit rebate of 50% of tax payable will be granted in ya 2025.

Source: philipgcortez.pages.dev

Source: philipgcortez.pages.dev

Iras Tax Rebate Ya 2025 Philip G. Cortez The government will provide a personal income tax (pit) rebate of 60% of tax payable for all tax resident individuals for the year of assessment (ya) 2025 (i.e., for income earned in 2024). A personal income tax (pit) rebate for ya 2025 will.

Source: landco.my

Source: landco.my

Personal Tax Relief Y.A. 2024 L & Co Accountants To provide support for companies’ cash flow needs, a cit rebate of 50% of tax payable will be granted in ya 2025. If the company has filed both their eci and company tax returns for ya 2025, iras will calculate the cit rebate based on the final tax.

Source: ringgitplus.com

Source: ringgitplus.com

Everything You Should Claim As Tax Relief Malaysia 2024 (YA 2023) To provide support for companies’ cash flow needs, a cit rebate of 50% of tax payable will be granted in ya 2025. The government will provide a personal income tax (pit) rebate of 60% of tax payable for all tax resident individuals for the year of assessment (ya) 2025 (i.e., for income earned in 2024).

Source: landco.my

Source: landco.my

Personal Tax Relief Y.A. 2025 L & Co Accountants The government will provide a personal income tax (pit) rebate of 60% of tax payable for all tax resident individuals for the year of assessment (ya) 2025 (i.e., for income earned in 2024). To provide support for companies’ cash flow needs, a cit rebate of 50% of tax payable will be granted in ya 2025.

Source: utayluella.pages.dev

Source: utayluella.pages.dev

Ira Rebates 2025 Miran Jesselyn If the company has filed both their eci and company tax returns for ya 2025, iras will calculate the cit rebate based on the final tax. Eligible companies will benefit from a 50% corporate income tax (cit) rebate for ya 2025, with a minimum benefit of $2,000.

Source: simonhughes.pages.dev

Source: simonhughes.pages.dev

Tax Rebate Ya 2025 Simon Hughes If the company has filed both their eci and company tax returns for ya 2025, iras will calculate the cit rebate based on the final tax. Eligible companies will benefit from a 50% corporate income tax (cit) rebate for ya 2025, with a minimum benefit of $2,000.